This is the first loss taken at Park Boulevard East. It's also noteable that this project is probably the newest actual condo project that has shown a losing transaction.

Resale Price: $520,000

Cost: $513,908

Loss@6% Sales Expenses: $25,108

Resale Date: 11/29/2005

Purchase Date: 06/22/2005

Holding Period: 5 Months

Bedrooms: 2

Bathrooms: 2

Square Feet: 1077

Purchase Details: view

Resale Details: view

Monday, July 31, 2006

325 S Sierra Ave #38, Solana Beach, CA 92075

Solana Beach isn't immune to the price declines.

Thanks to an Anonymous poster for point this property out.

Resale Price: $750,000

(Range priced: $725,100 - $774,900)

Cost: $800,000

Loss@6% Sales Expenses: $95,000

Purchase Date: 09/08/2005

Loss%: 11.88%

Holding Period: 10 months and counting...

Bedrooms: 2

Bathrooms: 2

Square Feet: 1230

Purchase Details: view

Thanks to an Anonymous poster for point this property out.

Resale Price: $750,000

(Range priced: $725,100 - $774,900)

Cost: $800,000

Loss@6% Sales Expenses: $95,000

Purchase Date: 09/08/2005

Loss%: 11.88%

Holding Period: 10 months and counting...

Bedrooms: 2

Bathrooms: 2

Square Feet: 1230

Purchase Details: view

Sunday, July 30, 2006

Downtown Condo at Crown Bay #404

First known loss at Crown Bay. This building is a midrise property in the Gaslamp Quarter across from the San Diego Convention Center

Resale Price: $440,000

Cost: $440,000

Loss@6% Sales Expenses: $26,400

Purchase Date: 07/01/2005

Holding Period: 12 months and counting...

Bedrooms: 1

Bathrooms: 1

Square Feet: 694

Purchase Details: view

Resale Price: $440,000

Cost: $440,000

Loss@6% Sales Expenses: $26,400

Purchase Date: 07/01/2005

Holding Period: 12 months and counting...

Bedrooms: 1

Bathrooms: 1

Square Feet: 694

Purchase Details: view

Saturday, July 29, 2006

6132 Mystra Pt., SD - Carmel Valley, CA 92130

Here's a condo in Carmel Valley that's been price cut substantially below late 2005 cost.

Resale Price: $599,900

Cost: $662,383

Loss@6% Sales Expenses: $98,477

Loss%: 14.87%

Purchase Date: 12/23/2005

Holding Period: 7 months and counting...

Bedrooms: 4

Bathrooms: 2

Square Feet: 1572

Purchase Details: view

Resale Price: $599,900

Cost: $662,383

Loss@6% Sales Expenses: $98,477

Loss%: 14.87%

Purchase Date: 12/23/2005

Holding Period: 7 months and counting...

Bedrooms: 4

Bathrooms: 2

Square Feet: 1572

Purchase Details: view

Friday, July 28, 2006

Very Interesting Article on Condo Sales Practices

I'm making a slight deviation from my usual posts about price depreciation to point out a very interesting article by Will Carless with the Voice of San Diego.

Make your own judgements about the article, as for me I'd never do business with real estate agents that are only concerned about their commission.

Make your own judgements about the article, as for me I'd never do business with real estate agents that are only concerned about their commission.

Thursday, July 27, 2006

Flipper Condo in Trouble at Metrome #608

Based on the pictures and the late 2005 closing date this condo has never been lived in. This is also interesting as most of examples of price decline are units purchased from flippers who bought from the developers. This unit was only changed hands once.

The loss figure below does not include negative cash flow, cost of staging and also assumes an unlikely full price offer.

Resale Price: $385,000

Cost: $381,200

Loss@6% Sales Expenses: $19,300

Bedrooms: 1

Bathrooms: 1

Square Feet: 716

Purchase Date: 10/25/2005

Holding Period: 9 months and counting...

Purchase Details: view

The loss figure below does not include negative cash flow, cost of staging and also assumes an unlikely full price offer.

Resale Price: $385,000

Cost: $381,200

Loss@6% Sales Expenses: $19,300

Bedrooms: 1

Bathrooms: 1

Square Feet: 716

Purchase Date: 10/25/2005

Holding Period: 9 months and counting...

Purchase Details: view

Wednesday, July 26, 2006

Foreclosed Downtown Condo at Renaissance #507

Listed on Foreclosure.com as fully foreclosed this unit ended up being owned by WMC Mortgage Corp which presumably was the lender on this unit.

Check out Foreclosure.com for a free trial to access more information on this unit.

The site shows this as inactive so let's assume the unit has changed hands again.

Resale Price: $627,500

Cost: $760,000

Loss@6% Sales Expenses: $170,150

Purchase Date: 10/25/2004

Purchase Details: view

Check out Foreclosure.com for a free trial to access more information on this unit.

The site shows this as inactive so let's assume the unit has changed hands again.

Resale Price: $627,500

Cost: $760,000

Loss@6% Sales Expenses: $170,150

Purchase Date: 10/25/2004

Purchase Details: view

526 Via De La Valle #A, Solana Beach, CA 92075

Thanks to an Anonymous poster for this example of a Solana Beach property. Note this has been on the market for 260+ days.

Resale Price: $645,000

Cost: $635,000

Loss@6% Sales Expenses: $28,700

(Note that it's very unlikely this unit will sell for list price so this loss estimate is conservative.)

Purchase Date: 03/01/2005

Purchase Details: view

Resale Price: $645,000

Cost: $635,000

Loss@6% Sales Expenses: $28,700

(Note that it's very unlikely this unit will sell for list price so this loss estimate is conservative.)

Purchase Date: 03/01/2005

Purchase Details: view

Tuesday, July 25, 2006

Downtown Condo at Treo #2106

Sunday, July 23, 2006

Failed Condo Conversion Investment - 4525 Florida Street

The Voice of San Diego reports "...an example a small apartment building in North Park that has sold four times in six years.

The building, 4525 Florida Street, sold in March 2004 for $2.1 million to an investor who planned on converting the property to condos. The investor spent tens of thousands of dollars getting the building permitted for condos but then decided to bail on the project as the condo market slumped. He then sold the property as an apartment building in May 2006 for $1.7 million -- netting a loss of at least $365,000."

My guess is that the loss here is much for than $365,000 as there is likely quite a lot of legal work and carry costs that the investor is also out.

The building, 4525 Florida Street, sold in March 2004 for $2.1 million to an investor who planned on converting the property to condos. The investor spent tens of thousands of dollars getting the building permitted for condos but then decided to bail on the project as the condo market slumped. He then sold the property as an apartment building in May 2006 for $1.7 million -- netting a loss of at least $365,000."

My guess is that the loss here is much for than $365,000 as there is likely quite a lot of legal work and carry costs that the investor is also out.

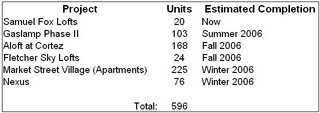

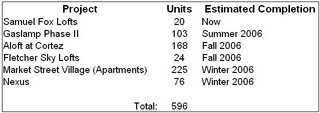

Downtown Projects Completing in 2006

I dropped by a downtown condo open house recently. The listing agent that was hosting the open house was talking about the market and how prices haven't gone down very much and since there are "no more new condos coming this year so the resale market will be steady."

I knew right away that there was at least once project completing so I did a little research. Below is a table of projects that should be completed in 2006.

In terms of sales activities at these projects I have heard that Aloft at Cortez Hill has about 50 units out of 168 under contract. There are units for sale at Sky and Samuel Fox Lofts and at Nexus.

If you know of any other projects completing in 2006 reply to this post and I'll update the post.

I knew right away that there was at least once project completing so I did a little research. Below is a table of projects that should be completed in 2006.

In terms of sales activities at these projects I have heard that Aloft at Cortez Hill has about 50 units out of 168 under contract. There are units for sale at Sky and Samuel Fox Lofts and at Nexus.

If you know of any other projects completing in 2006 reply to this post and I'll update the post.

Friday, July 21, 2006

Downtown Condo Sells for less than 2004 Value - Marina Park #425

This is a fairly old complex in the Marina District. Since the units are quite old I suspect that the unit was upgraded before the losing resale. I can't confirm this speculation however. This unit is very noteable as the resale price is LESS than what the property sold of in September 2004.

Resale Price: $560,000

Cost: $609,000

Loss@6% Sales Expenses: $82,600

Resale Date: 05/26/2006

Purchase Date: 09/24/2004

Holding Period: 20 months

Purchase Details: view

Resale Details: view

Resale Price: $560,000

Cost: $609,000

Loss@6% Sales Expenses: $82,600

Resale Date: 05/26/2006

Purchase Date: 09/24/2004

Holding Period: 20 months

Purchase Details: view

Resale Details: view

First Loss at the Downtown Condo Tower The Grande #1603

Here's the first known loss at The Grande, this unit is in the South tower as has changed hands three times. The second buyer lost $84,380 on the unit.

Resale Price: $573,000

Cost: $623,000

Loss@6% Sales Expenses: $84,380

Percentage Loss: 13.5%

Resale Date: 5/5/2006

Purchase Date: 12/13/2004

Holding Period: 1.40 Years

Cost Details: view

Sale Details: view

Resale Price: $573,000

Cost: $623,000

Loss@6% Sales Expenses: $84,380

Percentage Loss: 13.5%

Resale Date: 5/5/2006

Purchase Date: 12/13/2004

Holding Period: 1.40 Years

Cost Details: view

Sale Details: view

Tuesday, July 18, 2006

Acqua Vista #607

Yet another Acqua Vista Condo that has sold for a substantial loss. This was a 693 square foot 1 bed/1 bath unit.

Resale Price: $256,397

Cost: $311,080

Loss@6% Sales Expenses: $70,067

Percentage Loss: 22.5%

Resale Date: 5/25/2006

Purchase Date: 10/6/2004

Holding Period: 596 Days

Cost Details: view

Sale Details: view

Resale Price: $256,397

Cost: $311,080

Loss@6% Sales Expenses: $70,067

Percentage Loss: 22.5%

Resale Date: 5/25/2006

Purchase Date: 10/6/2004

Holding Period: 596 Days

Cost Details: view

Sale Details: view

Another Downtown Condo in Trouble - La Vita #1909

Here's another downtown condo that has a serious negative cash flow problem. Purchased for $810,000 on 4/15/2005 it's now for rent for $2,750 with owner paid electric bills. The rental listing also talks about $30,000 in owner upgrades - the pictures show a nice unit, no question on that.

Let's run some numbers on this, for this analysis I'll assume that the $840,000 "rents" for 4.35%, the same rate that you can get from ING Direct with and Orange Savings Account.

$840,000 @ 4.35% = $3,045 monthly

HOA is $395 monthly

Assume property tax of $200 montly

Total Monthly Cost: $3640

Rent $2,750 - 200 agency fee = $2,550

The unit is losing $1,100 per month.

To make matters more painful La Vita #1802 which has a superior bay view just sold for $725,000. La Vita #1802 unit was also featured on this blog. These units are virtually identical and make great comps. Assuming an identical sales price for this unit and standard 6% selling expenses the loss is a painful $158,500

Rental Listing: view

Purchase Details: view

Let's run some numbers on this, for this analysis I'll assume that the $840,000 "rents" for 4.35%, the same rate that you can get from ING Direct with and Orange Savings Account.

$840,000 @ 4.35% = $3,045 monthly

HOA is $395 monthly

Assume property tax of $200 montly

Total Monthly Cost: $3640

Rent $2,750 - 200 agency fee = $2,550

The unit is losing $1,100 per month.

To make matters more painful La Vita #1802 which has a superior bay view just sold for $725,000. La Vita #1802 unit was also featured on this blog. These units are virtually identical and make great comps. Assuming an identical sales price for this unit and standard 6% selling expenses the loss is a painful $158,500

Rental Listing: view

Purchase Details: view

Downtown Condo at Palermo #314

This unit is located in the Palermo which is another one of downtown's apartment conversions. It has been resold and was owned for about six months.

Resold Price: $368,000

Purchase Price: $371,800

Loss @6% Sales Expenses: $25,880

Resale Date: 5/25/05

Purchase Date: 11/5/04

Purchase Details: view

Resale Details: view

Resold Price: $368,000

Purchase Price: $371,800

Loss @6% Sales Expenses: $25,880

Resale Date: 5/25/05

Purchase Date: 11/5/04

Purchase Details: view

Resale Details: view

Monday, July 17, 2006

Downtown Condo at Acqua Vista #519

Purchased for $436,412 on 8/27/2004. This unit has been for sale for almost a year. This is the second known unit at Acqua Vista to go negative. I do think that at this point in the market virtually the entire complex is worth less or barely breakeven compared to where the units originally sold.

Current Price: $424,000

Purchase Price: $436,412

Loss @6% Sales Expenses: $37,852

Purchase Date: 8/27/2004

MLS#: 054060443

Purchase details: view

Current Price: $424,000

Purchase Price: $436,412

Loss @6% Sales Expenses: $37,852

Purchase Date: 8/27/2004

MLS#: 054060443

Purchase details: view

Sunday, July 16, 2006

Downtown Condo at Union Square #2608

While this condo shows a relatively minor loss it's notable that this loss is being taken by the initial buyer of the condo not someone that bought a flipped unit. This is the first time I have seen this at the Union Square development.

Current Price: $412,000

Purchase Price: $410,000

Loss @6% Sales Expenses: $22,720

Purchase Date: 1/26/2005

Purchase Details: view

MLS#: 061060268

Current Price: $412,000

Purchase Price: $410,000

Loss @6% Sales Expenses: $22,720

Purchase Date: 1/26/2005

Purchase Details: view

MLS#: 061060268

Friday, July 14, 2006

UPDATE: "777 Lofts at 6th Avenue - “For my age group, there's no way I can lose”"

Last month I posted an entry about the Lofts at 777 6th Ave.

At that time nine out of 103 units had been sold. The County of San Diego database has been updated and shows that three more units have closed sale.

At that pace the project will take over two and half years to sell out.

At that time nine out of 103 units had been sold. The County of San Diego database has been updated and shows that three more units have closed sale.

At that pace the project will take over two and half years to sell out.

Thursday, July 13, 2006

Interesting Facts Related to UT Price Decline Article

The Union Tribune Article that discusses our first year over year decline in prices in ten years had this interesting quote:

"Todd Fleischmann, 26, moved from Escondido to Portland, Ore., in January to take a new job. He has yet to sell his Escondido condominium, but he recently lowered the price from $361,5000 to $338,000."

I did a little bit of digging and based on my research this unit is MLS #066054078 and was purchased for $325,000 on 8/6/2004. Assuming a 6% sales charge and full price offer the owner is out $7280 and that's not including carrying costs as the MLS listing notes the property is vacant.

Nevertheless the unit is listed barely above what it sold for two years ago. I think the numbers are going to get much worse as we roll through 2006 and 2007.

"Todd Fleischmann, 26, moved from Escondido to Portland, Ore., in January to take a new job. He has yet to sell his Escondido condominium, but he recently lowered the price from $361,5000 to $338,000."

I did a little bit of digging and based on my research this unit is MLS #066054078 and was purchased for $325,000 on 8/6/2004. Assuming a 6% sales charge and full price offer the owner is out $7280 and that's not including carrying costs as the MLS listing notes the property is vacant.

Nevertheless the unit is listed barely above what it sold for two years ago. I think the numbers are going to get much worse as we roll through 2006 and 2007.

Wednesday, July 12, 2006

Wow, massive loss - 14688 CARMEL RIDGE, SD - Rancho Bernardo, CA 92128

This is a massive loss both cash and percentagewise from the last transaction on this property in late 2005.

This is from the MLS Listing Description:

Short sale!!! Short sale!!! Short sale!!!! Lender approval required to purchase property. Great deal (just check the comps). Bring your offers asap before you miss this great deal.

Current Price: $540,000-590,000

Purchase Price: $735,000

Loss @6% Sales Expenses: $227,400

Purchase Date: 12/23/2005

MLS#: 066058946

Purchase Details: view

Thanks to masayako on the Piggington site for finding this significant example of our declining real estate market.

This is from the MLS Listing Description:

Short sale!!! Short sale!!! Short sale!!!! Lender approval required to purchase property. Great deal (just check the comps). Bring your offers asap before you miss this great deal.

Current Price: $540,000-590,000

Purchase Price: $735,000

Loss @6% Sales Expenses: $227,400

Purchase Date: 12/23/2005

MLS#: 066058946

Purchase Details: view

Thanks to masayako on the Piggington site for finding this significant example of our declining real estate market.

Saturday, July 08, 2006

16.44% Loss in Less Than One Year - 350 West Ash #104

350 West Ash is a condominium project in downtown San Diego. It's an office building that was converted into condos.

This unit has already been resold. It was owned for slightly less than a year and assuming 6% cost to sell lead to a loss of $70,318 to the owner.

Resold Price: $380,000

Purchase Price: $427,518

Loss @6% Sales Expenses: $70,318

Resale Date: 5/31/2006

Purchase Date: 6/16/2005

Purchase Details: view

Resale Details: view

This unit has already been resold. It was owned for slightly less than a year and assuming 6% cost to sell lead to a loss of $70,318 to the owner.

Resold Price: $380,000

Purchase Price: $427,518

Loss @6% Sales Expenses: $70,318

Resale Date: 5/31/2006

Purchase Date: 6/16/2005

Purchase Details: view

Resale Details: view

Friday, July 07, 2006

Downtown Condo Project to be Auctioned Off

I normally don't post news articles, however a sale of an entire project before construction starts is a downtown San Diego first and is worth noting as another sign that that market has changed.

This article on the San Diego Daily Transcript website which does require registration/membership. You could also pickup a copy at the news rack.

Developer turns to auction of downtown condo, before ground broken

This article on the San Diego Daily Transcript website which does require registration/membership. You could also pickup a copy at the news rack.

Developer turns to auction of downtown condo, before ground broken

Monday, July 03, 2006

Laurel Bay Apartments - San Diego's First Reversion?

Thanks to SwimJet for pointing out and asking for more information of this project.

Laurel Bay Apartments is on Bankers Hill at the intersection of 5th and Laurel. It's actually a pretty nice building in a good location.

The apartment building was purchased by Hammer Ventures in June 2004 for $56.6 Million and was quickly converted to for sale condos.

There are 150 units in the building, County of San Diego records show that only 41 have been resold. Incredibly County records show only two closings in 2006. Sales are clearly slow for this project and given the price declines that are occuring downtown these condos will not sell at the current prices or the units will go back to rentals.

It's also worth noting that Foreclosure.com shows one unit at Laurel Bay is in preforeclosure proceedings.

SwimJet points out and I've also noticed that this building is very dark and there isn't much going on, this anecdotal observation and the hard facts indicate that this project simply isn't going well for the investors that converted the apartments into condos.

Based on my calculations there is around $32 Million dollars worth of condos sitting empty up on Bankers Hill. I arrived at this calucation by subtracting the total units sold as well as the resale of the commercial condos (~$7 Million) less estimated sales costs.

Could this be San Diego's first apartment conversion gone bad? As the national housing bubble deflates many of these projects are giving up on going condo.

You have to wonder how the 41 people that did but into the project will react when the remaining 100 units go back to rental status.

Laurel Bay Apartments is on Bankers Hill at the intersection of 5th and Laurel. It's actually a pretty nice building in a good location.

The apartment building was purchased by Hammer Ventures in June 2004 for $56.6 Million and was quickly converted to for sale condos.

There are 150 units in the building, County of San Diego records show that only 41 have been resold. Incredibly County records show only two closings in 2006. Sales are clearly slow for this project and given the price declines that are occuring downtown these condos will not sell at the current prices or the units will go back to rentals.

It's also worth noting that Foreclosure.com shows one unit at Laurel Bay is in preforeclosure proceedings.

SwimJet points out and I've also noticed that this building is very dark and there isn't much going on, this anecdotal observation and the hard facts indicate that this project simply isn't going well for the investors that converted the apartments into condos.

Based on my calculations there is around $32 Million dollars worth of condos sitting empty up on Bankers Hill. I arrived at this calucation by subtracting the total units sold as well as the resale of the commercial condos (~$7 Million) less estimated sales costs.

Could this be San Diego's first apartment conversion gone bad? As the national housing bubble deflates many of these projects are giving up on going condo.

You have to wonder how the 41 people that did but into the project will react when the remaining 100 units go back to rental status.

The Mills #531

As noted in a prior posting, the loft units at the Mills are quite possibly the most overpriced real estate in all of downtown San Diego. The Mills was built to be a rental community which was converted into condos at the end of the construction of the building so the quality just isn't there.

Here is another loft unit that's listed to leave the current owner with a loss. While I'm only counting the loss between purchase price and the current list price this unit has a ton of upgrades, much more than the typical Mills unit so this owner is out easily over $100K and that's if it sells for this price, fairly unlikely given the low quality of the building relative to what's going on in the rest of the market.

Current Price: $579,000

Purchase Price: $609,900

Loss @6% Sales Expenses: $65,640

Purchase Date: 3/16/2005

MLS#: 066009493

Purchase Details: view

Here is another loft unit that's listed to leave the current owner with a loss. While I'm only counting the loss between purchase price and the current list price this unit has a ton of upgrades, much more than the typical Mills unit so this owner is out easily over $100K and that's if it sells for this price, fairly unlikely given the low quality of the building relative to what's going on in the rest of the market.

Current Price: $579,000

Purchase Price: $609,900

Loss @6% Sales Expenses: $65,640

Purchase Date: 3/16/2005

MLS#: 066009493

Purchase Details: view

Saturday, July 01, 2006

Honey Who Shrunk the Equity? - The Mills #515

This is a two bedroom unit in The Mills which is in the Cortez Hill neighborhood downtown. The building was designed and built to be rentals but was converted at what might have been the peak of the market. The unit closed on 9/16/2004, nearly two years ago. The price paid back then was $549,500. The list price two years later? $549,000, which is still more than it's worth in today's market but if nothing else indicates zero appreciaton over two years.

Current Price: $549,000

Purchase Price: $549,500

Loss @6% Sales Expenses: $33,400

MLS: 061056325

Purchase details: view

Current Price: $549,000

Purchase Price: $549,500

Loss @6% Sales Expenses: $33,400

MLS: 061056325

Purchase details: view

Anatomy of an "Investment" - La Vita #1802

Speculators have not left the San Diego real estate market.

La Vita is a 23 story condo building in downtown's Little Italy neighborhood.

Unit #1802 was for sale for several months and finally went into and closed escrow at $725,000 this June.

This unit has hit the rental market for a whopping $3000 per month. Even if this investor gets this amount of money the negative cash flow is frankly stunning given what the market is doing. Note that water view La Vita two bedroom units are actually renting more in the $2300-2500 range so this over-priced rental will likley lag on the market for some time before finding a tenant.

Assuming a cost of funds of 6%, $400 HOA and standard taxes that monthly carrying cost of this unit is over $4000 resulting in a solid $1,000 negative cash flow. All this in a declining market.

Note that La Vita #2003 same floor plan, sold at the high in the market for $810,000.

Rental Listing:

http://sandiego.craigslist.org/apa/176430165.html

OR

http://www.tonytannouri.com/lavita

Finally the rental listing and the now expired for sale listing both talked about "permanent bay views", this is quite debatable as there is no known reason why the property in front of this unit cannot be developed. If you have any information pro or con to this effect by all means post a reply. I'd love to know the facts.

La Vita is a 23 story condo building in downtown's Little Italy neighborhood.

Unit #1802 was for sale for several months and finally went into and closed escrow at $725,000 this June.

This unit has hit the rental market for a whopping $3000 per month. Even if this investor gets this amount of money the negative cash flow is frankly stunning given what the market is doing. Note that water view La Vita two bedroom units are actually renting more in the $2300-2500 range so this over-priced rental will likley lag on the market for some time before finding a tenant.

Assuming a cost of funds of 6%, $400 HOA and standard taxes that monthly carrying cost of this unit is over $4000 resulting in a solid $1,000 negative cash flow. All this in a declining market.

Note that La Vita #2003 same floor plan, sold at the high in the market for $810,000.

Rental Listing:

http://sandiego.craigslist.org/apa/176430165.html

OR

http://www.tonytannouri.com/lavita

Finally the rental listing and the now expired for sale listing both talked about "permanent bay views", this is quite debatable as there is no known reason why the property in front of this unit cannot be developed. If you have any information pro or con to this effect by all means post a reply. I'd love to know the facts.

Subscribe to:

Posts (Atom)